Consilium provides independent and ongoing investment governance oversight to support advisers and their investment teams. Our disciplined process gives you confidence that the investment advice you provide is based on strong foundations, and the investments you recommend are all regularly and thoroughly monitored.

Our solutions

Professional investment monitoring

How it works

Comprehensive initial review

Our investment engagement process involves a comprehensive initial review and analysis of your existing model portfolios. This includes a quantitative review of all existing funds in your portfolios, calculation of expected risk and return parameters and the calculation of historic returns of the portfolios, underlying funds and benchmark indices. As part of the initial analysis, you will receive an interactive tool that graphically illustrates the risk and return of your portfolios.

![]()

Ongoing performance monitoring

Once we have reviewed your portfolios and shared our findings, our ongoing performance monitoring delivers a quarterly due diligence reports and performance calculations. This enables you to clearly demonstrate the robust governance and oversight supporting your investment advice.

![]()

Investment governance program

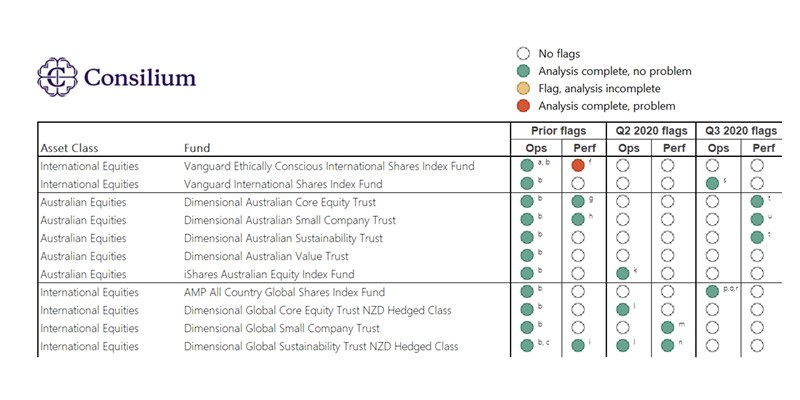

The investment governance program ensures your model portfolio assets are forensically reviewed each quarter to verify that recommended funds are delivering an appropriate level of return in the prevailing market environment.

This requires a detailed analysis of investment returns and fundamental data, and culminates in detailed monitoring and performance reporting.

Our CEFEX approved monitoring program flags any matter for further investigation, helping ensure the investment strategy you put into place stays on target.

Performance reporting

Consilium calculates the quarterly returns of your model portfolios, and produces a quarterly performance report to illustrate the performance of each fund in the portfolio and the overall portfolio performance.

The report includes a comprehensive set of performance graphs and as well as a comparison between the portfolio performance and the relevant ‘benchmark’ blended index portfolio over a range of time frames.

Professional portfolio monitoring

Each quarter, Consilium completes a comprehensive quantitative and qualitative review of each asset in your model portfolio.

This involves a review of the asset’s performance against it’s relevant benchmark statistical analysis looking at changes and where applicable, in the fund’s underlying assets as well as its relative market capitalisation, price-to-book and profitability metrics. A range of additional qualitative information requested from each fund manager is also reviewed quarterly.

Enhanced Due Diligence (EDD)

Through the investment monitoring program, Consilium may identify questions relating to a specific fund that require further investigation. If this occurs, a fund will be placed on an EDD list and subjected to a higher degree of scrutiny.

If a fund is flagged for EDD, Consilium will confirm this as part of the quarterly investment monitoring and will subsequently produce an EDD report outlining the results of the detailed investigation.

Client ready communications

To support the ongoing monitoring program and assist you to explain and enhance the value of your advice, Consilium will provide you with access to a library of investment related articles and research. These articles can be used in your own publications or investor newsletters.

Consilium will also provide you with template wording describing the investment monitoring service that can be included in your investment policy statement.

Our disciplined process gives you peace of mind

Contact us today and speak to our Business Development Manager for more information.